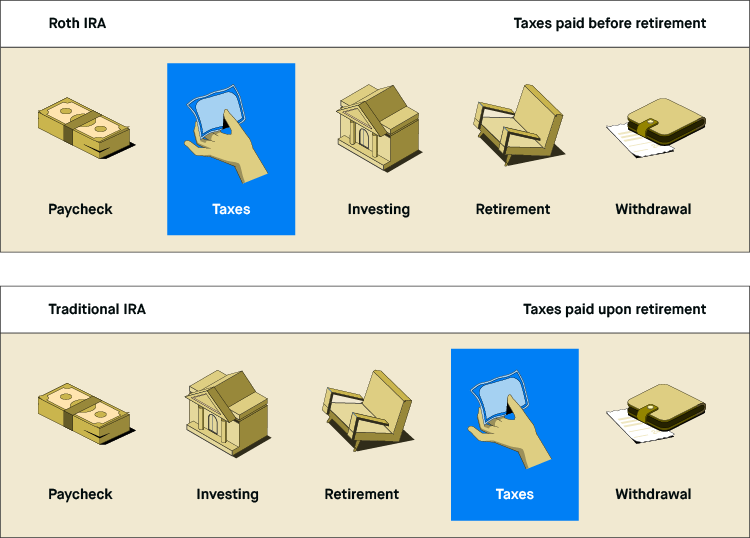

With a roth ira you pay taxes on your income before you make a contribution and you won t owe additional taxes if you withdraw the money according to federal rules.

Open roth ira robinhood.

You fund your account and choose investments.

Btw i am a college student with little disposable income to invest 200 a month.

I currently trade using the robinhood app but is there any way possible to open a roth ira account for tax purposes.

How much can you put into a roth ira.

Unlike a traditional ira a roth ira account lets you make contributions with after tax dollars this means you pay income taxes on the money before you move it your roth ira.

Open roth ira through robinhood.

Let s say you want to start saving money for retirement.

Robinhood minimum balance requirement for brokerage.

Robinhood minimum initial deposit to open roth ira traditional ira simple ira or sep ira.

For 2020 the maximum contribution to a roth ira is 6 000 per year but if you re 50 or older that increases to 7 000 per year.

Ira accounts are not offered at robinhood.

There is a bit of a.

While this means you ll pay taxes now contributing to a roth ira can make a big difference in the future.

Robinhood financial is a relatively new app based broker that allows users to easily trade most stocks and etfs commission free without all the bells and whistles that come with the more traditional online brokers.

While there s a roth ira maximum contribution amount there s no minimum according to irs rules.

2 000 in cash and or securities.

A roth ira is a type of retirement account that allows people to save money invest it and reap certain tax benefits.

Robinhood minimum investment to open brokerage account.

Open ally invest account what is robinhood.

As of 2019 you can contribute up to 6 000 a year or 7 000 a year if you re over 50 and can deduct part or all of that amount on your income taxes depending on your income.

How to start a roth ira.

Opening a roth ira can be as simple as visiting your bank s website and filling out an online application.

The good news is that the irs doesn t require a minimum amount to open a roth ira.

You do your research and decide that a traditional ira is right for you.

In 2020 the roth ira contribution limit is 6 000 or 100 of income a child earns whichever is less.