State laws and corporate policies vary but most banks aren t going to open accounts for anybody under 18 unless there s also an adult on the account.

Open bank account for child chase.

You can open a savings account for kids in your name alone or in your name and your kid s name.

Chase bank kids savings account.

Open a savings account or open a certificate of deposit see interest rates and start saving your money.

If your teenage kids prove they can handle a savings account then it might be time to add a checking account with a debit card.

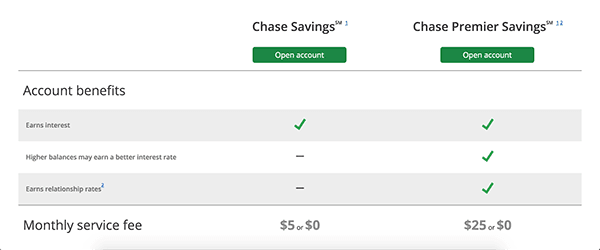

Compare chase savings accounts and select the one that best suits your needs.

1 open a new chase savings sm account which is subject to approval.

Jpms cia and jpmorgan chase bank n a.

Are affiliated companies under the common control of jpmorgan chase co.

That s also the way you make deposits to and withdrawals from your account with us.

Chase high school checking is for student ages 13 17 at account opening with their parent guardian as a co owner.

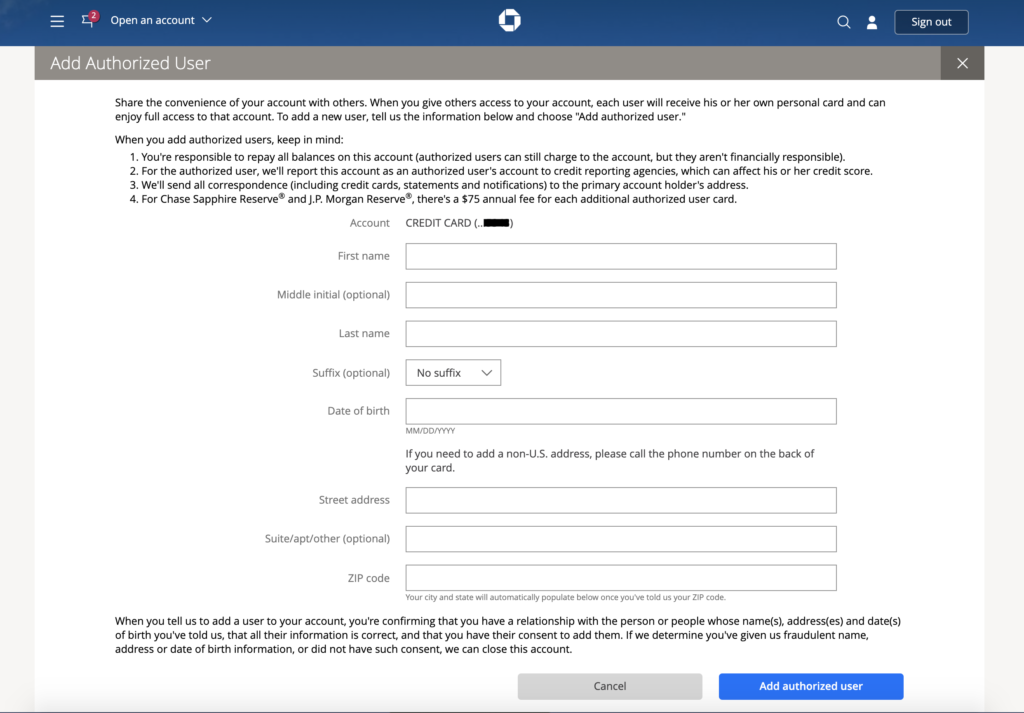

You ll need to co sign any bank accounts for minors.

2 deposit a total of 10 000 or more in new money within 20 business days of account opening.

Help your child start saving with chase savings.

Chase private client is the brand name for a banking and investment product and service offering.

Then just link your kids savings account to your existing capital one account or personal checking account at any u s.

Learn about the benefits of a chase savings account online.

Take control of your spending by opening an account in a branch.

This can help children understand banking transactions while establishing their early financial history.

Jpmorgan chase bank n a.

The parent must have an existing qualifying chase checking account which must be linked to the high school checking account.

Or any of its affiliates subject to.

Savings accounts and certificate of deposit accounts are fdic insured up to the maximum amount allowed by law.

Products not available in all states.

For people under the age of 18 opening a bank account is hard.

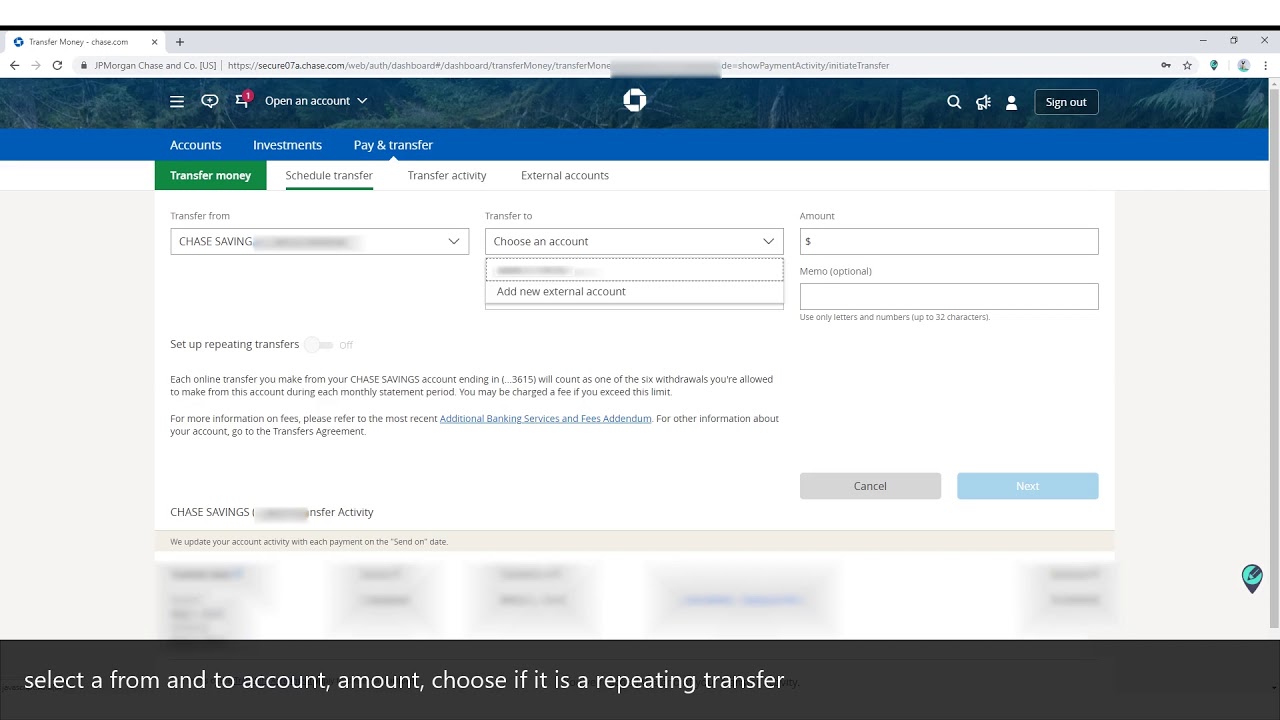

The deposit agreement and disclosures limits the number of the following types of withdrawals and transfers from a savings account to a total of six 6 each monthly statement cycle or each month for savings accounts with a quarterly statement cycle including online and mobile banking transfers or payments.

The problem is that you need to sign a contract to open an account and contracts signed by minors are complicated.